In recent months, the Federal Government of Nigeria has intensified efforts to widen access to higher education through the Nigerian Education Loan Fund (NELFund), popularly known as the student loan scheme. This initiative, anchored on the Students’ Loans (Access to Higher Education) Act, is designed to remove financial barriers for Nigerian students and provide them with sustainable funding for tuition, upkeep, and other academic expenses.

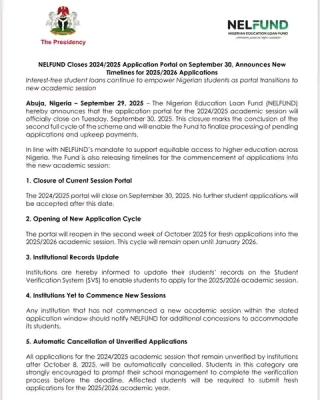

Since its rollout, the scheme has attracted huge attention from students, parents, and stakeholders in the education sector. Many see it as a game-changer that could redefine access to tertiary education in the country. Yet, questions remain about how the application process works, what documents are required, and, importantly, how repayment will be handled once beneficiaries graduate.

This report breaks down the entire NELFund process — from eligibility and application to disbursement and repayment — in clear detail, helping Nigerian students understand what to expect and how best to take advantage of the opportunity.

What is NELFund and Why Was It Introduced?

NELFund is the Federal Government’s official student loan scheme aimed at addressing the growing financial challenges faced by Nigerian students in tertiary institutions. It was established to ensure that no student is denied access to education on the basis of financial incapacity.

The loan covers tuition fees, institutional charges, and, in some cases, personal upkeep allowances. Funds are disbursed directly to institutions to cover school fees, while upkeep allowances are credited to the student’s bank account. The fund is managed under a structured system, with strict guidelines for eligibility, application, and repayment.

Who is Eligible to Apply?

The NELFund loan is not open to everyone automatically; applicants must meet certain conditions. Below are the key eligibility requirements:

- Must be a Nigerian citizen.

- Must have secured admission into an accredited tertiary institution (federal, state, or accredited vocational/technical colleges).

- Must provide verifiable details such as NIN, BVN, and institutional admission/matriculation information.

- Applicants must not be beneficiaries of duplicate government-funded scholarships covering the same fees.

- Students must be ready to agree to repayment terms at the point of application.

By design, the scheme is inclusive, covering students from diverse social and economic backgrounds, including those in universities, polytechnics, colleges of education, and technical institutions.

Documents and Information Required

To ensure a smooth application process, applicants are required to present specific documents and information. These include:

- National Identification Number (NIN) and other valid ID cards.

- Admission or matriculation letter from the institution.

- School fee invoice or proof of institutional charges.

- BVN-linked bank account details.

- Passport-sized photograph.

- In cases of self-employment (after graduation), business registration documents may later be required.

Failure to provide accurate details or mismatched information across NIN, BVN, and school records can lead to delays or outright rejection.

Step-by-Step Guide to the Application Process

The application process is designed to be simple and student-friendly. Below is a step-by-step breakdown:

- Create an Account – Students are expected to register on the official student loan portal, providing their NIN and personal details.

- Verify Institution Details – Select your school from the list of accredited institutions and upload relevant academic documents such as admission or matriculation letter.

- Complete the Loan Application Form – Indicate the type of loan (tuition only or tuition plus upkeep) and fill in the required amounts.

- Upload Required Documents – This includes identification, school fee invoices, bank details, and photographs.

- Submit for Verification – The school verifies your enrollment and fee details, after which NELFund processes the loan.

- Disbursement – Tuition is paid directly to the institution, while upkeep (if approved) goes into the student’s account.

The portal makes it possible to track your application status in real time, and applicants are encouraged to log in regularly for updates.

Disbursement and Funding Structure

NELFund operates on a dual disbursement structure:

- Institutional Payment: Tuition and charges are paid directly to schools, ensuring accountability and eliminating misuse of funds.

- Student Upkeep Allowance: For those who applied for it, upkeep funds are credited directly to the student’s bank account.

This two-way structure ensures transparency, proper monitoring, and financial support to students where it matters most.

Repayment: What Every Student Must Know

One of the most frequently asked questions about NELFund concerns repayment. Unlike commercial loans, this scheme is structured to ease the burden on graduates and allow them to settle obligations gradually.

Here are the key repayment rules:

- Grace Period: Repayment begins two years after completion of NYSC (for those who participate in the service year).

- Repayment for Employees: Beneficiaries in paid employment will have 10% of their monthly salary deducted at source until the loan is fully repaid. Employers are mandated to remit this to the Fund.

- Repayment for Self-Employed Graduates: Those who establish businesses must, within 60 days, update their employment status on the loan portal and provide business registration and banking details for repayment arrangements.

- Prepayment Allowed: Graduates who wish to pay off their loan earlier are free to do so without penalty.

- Default and Enforcement: The Fund reserves the right to use legal instruments such as the Global Standing Instruction (GSI) to recover funds from defaulters.

Importantly, the scheme has been described as interest-free during the study period, making it more accessible than conventional loan systems.

Scenarios of Repayment

To make repayment clearer, let us look at two practical scenarios:

- Scenario 1 – Employed Graduate

A graduate secures a job with a salary of ₦180,000 two years after NYSC. Automatically, ₦18,000 (10% of salary) will be deducted monthly until the loan balance is cleared. - Scenario 2 – Self-Employed Graduate

Another graduate registers a business and starts earning income after NYSC. Within 60 days of commencing the business, they must update their portal details and commence structured repayment as agreed with NELFund.

What Happens in Special Cases?

- Unemployment: If a graduate is unable to secure employment two years after NYSC, they are expected to notify the Fund and provide necessary affidavits for possible deferment.

- Death: In the event of a borrower’s death, the repayment obligation ceases, and the Fund closes the account accordingly.

- Default: Students who intentionally refuse to repay after securing employment risk penalties, including legal recovery actions.

Why NELFund Matters to Nigerian Education

The launch of NELFund comes at a critical time when tuition costs and living expenses are rising sharply. Many Nigerian students face financial pressure that often forces them to abandon their education midway. With this scheme, access to loans provides a lifeline and helps to bridge inequality in education.

Beyond tuition support, NELFund has the potential to boost enrollment rates in tertiary institutions, empower more youths to acquire skills, and contribute to Nigeria’s human capital development.

Final Thoughts

NELFund represents a bold step by the Federal Government towards improving access to quality education for all Nigerians, regardless of financial background. While concerns remain about repayment monitoring and the realities of graduate unemployment, the framework offers a structured and supportive system for students to pursue their academic dreams without fear of immediate financial burdens.

For students, the key is to understand the requirements, prepare the necessary documents, and apply on time. More importantly, beneficiaries must plan ahead for repayment to avoid default and ensure the sustainability of the scheme for future generations.